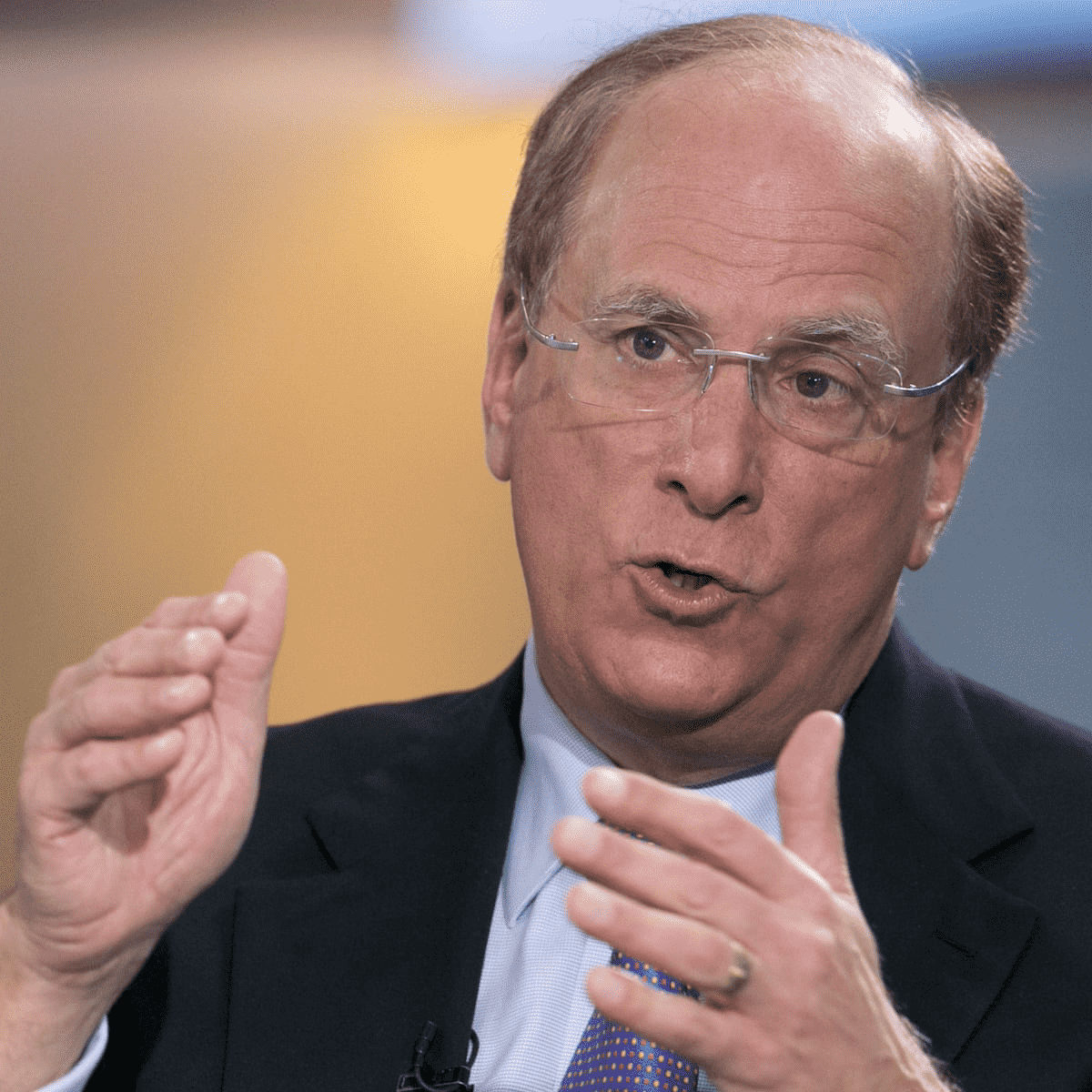

Larry Fink's journey to the pinnacle of the financial world is a testament to his resilience and innovation. Born into a modest family, Fink's ascent to becoming one of the most influential figures in finance is a story of determination and foresight. His early career in First Boston and later founding BlackRock in 1988 laid the foundation for a revolutionary approach to asset management. Fink's emphasis on risk management and technology integration has propelled BlackRock to manage trillions of dollars in assets, continuously adapting to global economic shifts and client needs. Beyond his professional achievements, Larry Fink is also known for his bold and progressive stance on corporate governance and sustainability. His annual letters to CEOs have become a much-anticipated event, where he articulates the importance of long-term thinking and responsibility towards stakeholders. Fink's advocacy for sustainable investing has not only influenced market trends but has also sparked a global dialogue on the role of corporations in addressing climate change and societal challenges. As we delve deeper into Larry Fink's biography, leadership style, and vision, we uncover a narrative of innovation, resilience, and a relentless pursuit of excellence.

Table of Contents

- Biography of Larry Fink

- What was Larry Fink's early life like?

- Career Beginnings and Rise to Prominence

- Founding of BlackRock and Strategic Growth

- How does Larry Fink lead?

- Advocacy for ESG and Sustainable Investing

- Impact of Larry Fink's Annual Letters to CEOs

- Larry Fink's Personal Life and Interests

- How did Larry Fink revolutionize the finance industry?

- Role in the Global Economy

- Challenges Faced and Overcome

- Philanthropy and Social Contributions

- Larry Fink's Vision for the Future

- Frequently Asked Questions

- Conclusion

Biography of Larry Fink

Larry Fink was born on November 2, 1952, in Los Angeles, California. Raised in a Jewish family, Fink's upbringing in a supportive and nurturing environment played a crucial role in shaping his values and ambitions. His father owned a shoe store, while his mother was an English professor. This blend of entrepreneurship and academia influenced Fink's perspective on business and education.

Fink completed his Bachelor of Arts degree in Political Science from the University of California, Los Angeles (UCLA), and later pursued an MBA at the UCLA Anderson School of Management. His academic pursuits laid the groundwork for his analytical and strategic thinking, skills that would later define his career in finance.

Read also:Find The Best Buca Di Beppo Near Me Your Guide To Italian Dining Excellence

| Personal Details | Information |

|---|---|

| Full Name | Larry D. Fink |

| Date of Birth | November 2, 1952 |

| Place of Birth | Los Angeles, California, USA |

| Education | BA in Political Science, MBA |

| Occupation | CEO of BlackRock |

| Net Worth | Approx. $1 billion (as of 2023) |

What was Larry Fink's early life like?

Larry Fink's early life was marked by a blend of cultural heritage and a strong emphasis on education and values. Growing up in Los Angeles, he was exposed to a diverse environment that fostered his curiosity and ambition. His family's modest means did not deter him from aspiring for greatness; instead, it instilled in him a work ethic and determination that would later become his hallmark.

During his formative years, Fink displayed an affinity for leadership and an interest in financial markets. His involvement in student activities and leadership roles during his academic years laid the groundwork for his future endeavors. The influence of his parents, who emphasized the importance of education and hard work, was evident in his pursuit of higher education and subsequent career choices.

Career Beginnings and Rise to Prominence

After completing his MBA, Larry Fink began his career at First Boston, a prominent investment bank. His initial role involved fixed-income trading, where he quickly demonstrated his prowess in understanding market dynamics and risk management. Fink's innovative approach to mortgage-backed securities and his ability to foresee market trends earned him recognition and respect within the industry.

However, the journey was not without its challenges. A significant setback occurred in the late 1980s when a miscalculation in interest rates led to a substantial financial loss for First Boston. This experience served as a turning point for Fink, reinforcing the importance of risk management and strategic foresight in investment practices.

Founding of BlackRock and Strategic Growth

In 1988, Larry Fink co-founded BlackRock with a vision to create a firm that prioritized risk management and innovative investment solutions. Initially part of Blackstone Group, BlackRock eventually became an independent entity, with Fink at the helm as CEO. Under his leadership, BlackRock experienced exponential growth, expanding its portfolio and establishing a global presence.

Fink's strategic focus on technology and data analytics transformed BlackRock into a leader in asset management. The firm's proprietary technology platform, Aladdin, became a cornerstone of its operations, providing clients with real-time insights and risk assessments. This technological edge, combined with Fink's emphasis on client relationships, propelled BlackRock to manage assets worth trillions of dollars by the early 21st century.

Read also:Mastering Conversations The Power Of Spicychat Ai

How does Larry Fink lead?

Larry Fink's leadership style is characterized by a combination of visionary thinking, strategic acumen, and a deep commitment to corporate responsibility. He is known for his ability to anticipate market trends and adapt to changing economic landscapes, ensuring that BlackRock remains at the forefront of the industry.

Fink's open and inclusive approach to leadership fosters a culture of innovation and collaboration within BlackRock. He encourages a diverse range of perspectives and values the contributions of his team members, recognizing that diversity drives creativity and problem-solving. His emphasis on transparency and accountability has earned him the trust and respect of both his employees and clients.

Advocacy for ESG and Sustainable Investing

One of Larry Fink's most significant contributions to the financial world is his advocacy for environmental, social, and governance (ESG) investing. Fink has been a vocal proponent of incorporating sustainability into investment decisions, emphasizing the importance of long-term value creation and corporate responsibility.

Under Fink's leadership, BlackRock has integrated ESG criteria into its investment strategies, encouraging companies to adopt sustainable practices and reduce their environmental impact. This approach not only aligns with Fink's vision for a sustainable future but also reflects the growing demand from investors for responsible and ethical investment options.

Impact of Larry Fink's Annual Letters to CEOs

Each year, Larry Fink's annual letters to CEOs are eagerly anticipated by the business community and beyond. These letters serve as a platform for Fink to articulate his views on critical issues such as corporate governance, sustainability, and social responsibility. His candid and thoughtful insights have sparked meaningful conversations and encouraged companies to reevaluate their strategies and operations.

Fink's letters often emphasize the importance of long-term thinking and stakeholder engagement, urging CEOs to prioritize sustainable growth and consider the broader impact of their decisions. His influence extends beyond BlackRock, inspiring companies around the world to embrace a more holistic approach to business.

Larry Fink's Personal Life and Interests

Away from the boardroom, Larry Fink leads a life grounded in family values and personal interests. Married to his wife Lori since the 1970s, the couple has three children. Fink's commitment to family and community is evident in his philanthropic endeavors and support for various charitable causes.

In his leisure time, Fink enjoys engaging in outdoor activities such as hiking and skiing. His love for nature aligns with his advocacy for environmental sustainability, reflecting his personal commitment to preserving the planet for future generations.

How did Larry Fink revolutionize the finance industry?

Larry Fink's impact on the finance industry is undeniable. Through his visionary leadership and strategic innovations, he has redefined asset management and risk assessment. Fink's introduction of technology-driven solutions and emphasis on data analytics have set new standards for the industry, enabling investors to make informed decisions and manage risks effectively.

Fink's influence extends beyond technological advancements; his commitment to sustainable investing has reshaped market dynamics and encouraged companies to prioritize ESG criteria. By advocating for a more responsible and ethical approach to business, Fink has revolutionized the finance industry and paved the way for a more sustainable future.

Role in the Global Economy

Larry Fink's leadership and insights have positioned him as a prominent figure in the global economy. As the CEO of BlackRock, he plays a crucial role in shaping investment strategies and influencing market trends. Fink's emphasis on sustainability and long-term value creation aligns with the evolving needs of investors and the global economy.

His participation in international forums and dialogues further underscores his influence and commitment to addressing global challenges. Fink's perspective on economic issues and market dynamics is valued by policymakers, industry leaders, and investors worldwide, making him a key contributor to the global economic landscape.

Challenges Faced and Overcome

Larry Fink's journey to success has not been without its share of challenges. From navigating financial crises to addressing evolving market demands, Fink has demonstrated resilience and adaptability in the face of adversity. His ability to learn from setbacks and turn challenges into opportunities has been instrumental in BlackRock's growth and success.

Fink's emphasis on risk management and strategic foresight has enabled him to steer BlackRock through turbulent times, ensuring the firm's stability and continued growth. His leadership during the 2008 financial crisis, in particular, highlighted his ability to navigate complex challenges and make informed decisions that benefit both the firm and its clients.

Philanthropy and Social Contributions

Larry Fink is not only a leader in the financial world but also a committed philanthropist. He actively supports various charitable causes, particularly those related to education, healthcare, and environmental conservation. Fink's philanthropic efforts reflect his belief in giving back to society and making a positive impact on the lives of others.

His involvement in philanthropic initiatives and support for non-profit organizations demonstrate his commitment to addressing social challenges and contributing to the betterment of communities worldwide. Fink's dedication to philanthropy is an extension of his values and vision for a more equitable and sustainable world.

Larry Fink's Vision for the Future

Looking ahead, Larry Fink remains committed to driving positive change and innovation in the financial industry. His vision for the future centers on sustainable growth, responsible investing, and the integration of technology to enhance investment solutions. Fink's leadership will undoubtedly continue to shape BlackRock's trajectory and influence market trends.

Fink's focus on sustainability and long-term value creation aligns with the evolving needs of investors and the global economy. His commitment to addressing climate change and advocating for responsible business practices underscores his vision for a more sustainable and equitable future. As Fink continues to lead by example, his impact on the financial industry and beyond will undoubtedly endure.

Frequently Asked Questions

- What is Larry Fink known for?

Larry Fink is known for being the co-founder and CEO of BlackRock, the world's largest asset management firm. He is renowned for his leadership in the finance industry and advocacy for sustainable investing.

- How did Larry Fink start BlackRock?

Larry Fink co-founded BlackRock in 1988 with a focus on risk management and innovative investment solutions. The firm was initially part of Blackstone Group before becoming an independent entity.

- What is Larry Fink's stance on ESG investing?

Larry Fink is a vocal proponent of ESG investing, emphasizing the importance of incorporating sustainability and corporate responsibility into investment decisions.

- What are Larry Fink's annual letters to CEOs about?

Larry Fink's annual letters to CEOs address critical issues such as corporate governance, sustainability, and social responsibility, encouraging long-term thinking and stakeholder engagement.

- What are some of Larry Fink's philanthropic efforts?

Larry Fink supports various charitable causes related to education, healthcare, and environmental conservation, reflecting his commitment to giving back to society.

- What is Larry Fink's vision for the future?

Larry Fink's vision for the future focuses on sustainable growth, responsible investing, and technology integration to enhance investment solutions and address global challenges.

Conclusion

Larry Fink's legacy in the financial industry is marked by his visionary leadership, strategic innovations, and commitment to sustainability. As the CEO of BlackRock, he has redefined asset management and risk assessment, setting new standards for the industry. Fink's advocacy for ESG investing and corporate responsibility has reshaped market dynamics and inspired companies worldwide to adopt sustainable practices.

Beyond his professional achievements, Fink's philanthropic efforts and commitment to social contributions reflect his values and dedication to making a positive impact on society. His influence extends beyond BlackRock, as he continues to drive meaningful change and innovation in the financial world.

As we reflect on Larry Fink's journey and accomplishments, it is clear that his leadership and vision will continue to shape the future of finance and inspire generations to come. His legacy serves as a testament to the power of resilience, innovation, and a relentless pursuit of excellence.