The Chase Sapphire Reserve card has become synonymous with luxury travel benefits, offering an array of perks that cater to avid travelers and those who enjoy the finer things in life. With its competitive rewards program, extensive travel insurance coverage, and exclusive access to airport lounges, the Chase Sapphire Reserve card stands out as a premium choice for credit card holders. This article delves into the myriad benefits and features of the Chase Sapphire Reserve, providing insights into how cardholders can maximize their rewards and enjoy unparalleled experiences.

The allure of the Chase Sapphire Reserve card lies not only in its robust rewards structure but also in the unique travel experiences it offers. Cardholders can earn substantial points on travel and dining purchases, which can then be redeemed for travel through the Chase Ultimate Rewards portal. Additionally, the card's impressive travel insurance benefits and no foreign transaction fees make it an ideal companion for international adventures.

In the following sections, we will explore the various aspects of the Chase Sapphire Reserve card, including its benefits, fees, rewards program, and how to make the most of its features. We will also address common questions and provide expert tips on leveraging the card's offerings to enhance your travel experiences. Whether you're a seasoned traveler or new to the world of luxury credit cards, this guide will equip you with the knowledge needed to fully appreciate the Chase Sapphire Reserve card.

Read also:Understanding Libra Traits Balancing Charm And Diplomacy

Table of Contents

- What is the Chase Sapphire Reserve?

- Key Benefits of the Chase Sapphire Reserve

- Understanding the Rewards Program

- How to Maximize Your Points?

- Travel Benefits and Insurance

- Complimentary Lounge Access

- Fees and Charges

- Is the Annual Fee Worth It?

- Tips for Using the Chase Sapphire Reserve

- How Does It Compare to Other Cards?

- Frequently Asked Questions

- Conclusion

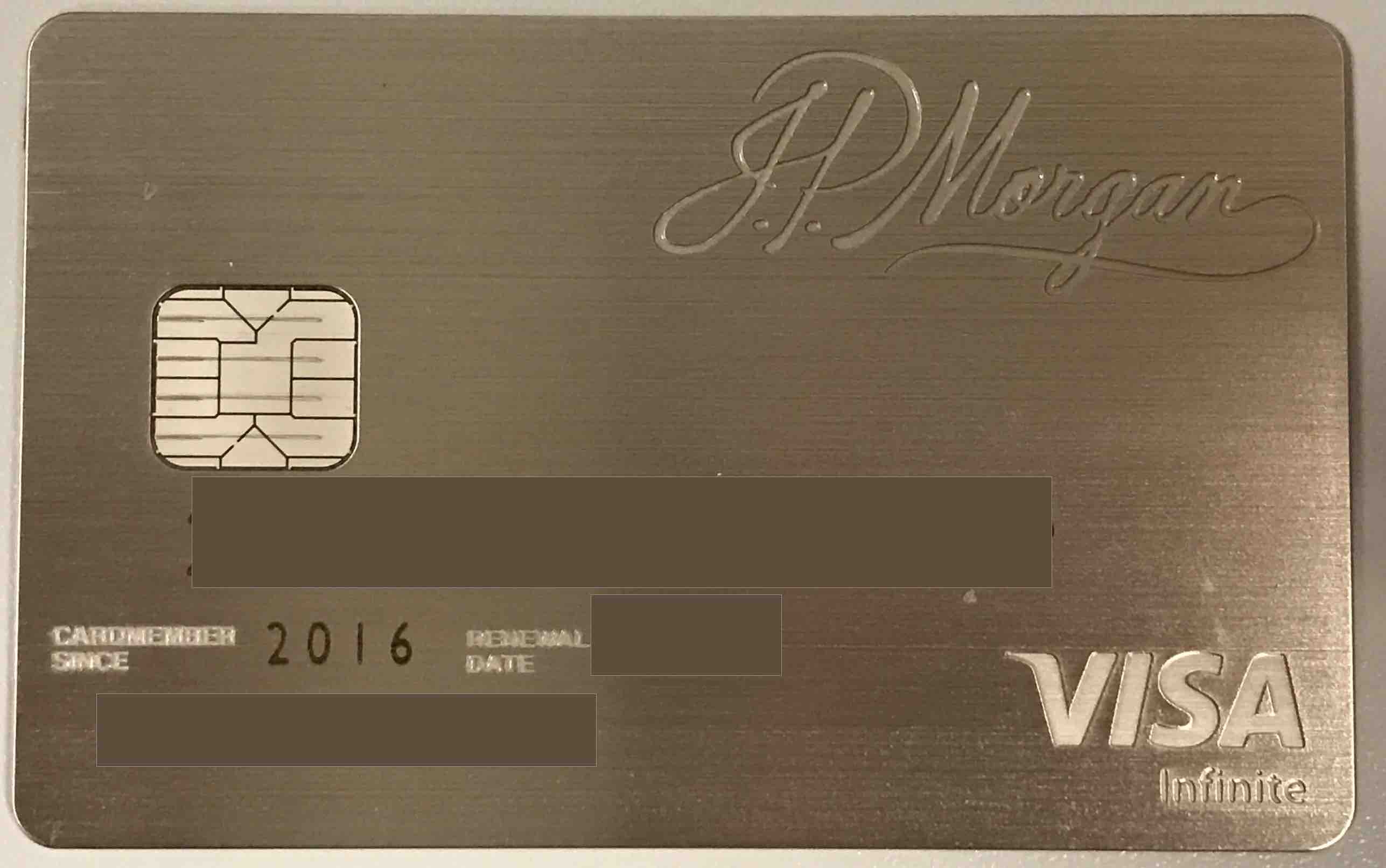

What is the Chase Sapphire Reserve?

The Chase Sapphire Reserve is a premium travel credit card offered by JPMorgan Chase. It is renowned for its comprehensive travel benefits, including rewards for travel-related spending, complimentary airport lounge access, and extensive travel insurance coverage. The card is tailored for individuals who prioritize travel perks and are willing to pay a higher annual fee to access exclusive experiences and benefits.

Key Benefits of the Chase Sapphire Reserve

The Chase Sapphire Reserve card offers a host of benefits that appeal to luxury travelers and frequent diners. Here are some of the key features:

- Triple points on travel and dining purchases.

- Annual travel credit of $300, which automatically reimburses travel-related purchases.

- Complimentary Priority Pass Select membership for airport lounge access.

- Comprehensive travel insurance coverage, including trip cancellation/interruption and baggage delay insurance.

- No foreign transaction fees, making it ideal for international use.

Understanding the Rewards Program

The Chase Sapphire Reserve card's rewards program is designed to offer flexibility and value to cardholders. Here's how it works:

- Earn 3x points on travel immediately after earning your $300 travel credit.

- Earn 3x points on dining at restaurants, including eligible delivery services, takeout, and dining out.

- Earn 1 point per dollar on all other purchases.

- Points are worth 50% more when redeemed for travel through the Chase Ultimate Rewards portal.

Cardholders can transfer points to a wide range of travel partners, including major airlines and hotel chains, maximizing their redemption options.

How to Maximize Your Points?

Maximizing points with the Chase Sapphire Reserve card requires strategic spending and smart redemption choices. Here are some tips to enhance your rewards:

- Focus spending on travel and dining to take advantage of the 3x points multiplier.

- Utilize the Chase Ultimate Rewards portal for booking travel to benefit from the 50% points boost.

- Transfer points to airline and hotel partners when the transfer ratio offers better value.

- Combine points with other Chase cards that earn Ultimate Rewards points for added flexibility.

Travel Benefits and Insurance

The Chase Sapphire Reserve card is equipped with an impressive suite of travel benefits and insurance coverage that provides peace of mind for travelers:

Read also:Kim Director A Spotlight On The Acclaimed Actress

- Trip Cancellation/Interruption Insurance: Reimbursements up to $10,000 per person and $20,000 per trip for prepaid, non-refundable travel expenses.

- Auto Rental Collision Damage Waiver: Primary coverage when renting a car, covering damage due to collision or theft.

- Lost Luggage Reimbursement: Up to $3,000 per passenger for lost or damaged luggage.

- Trip Delay Reimbursement: Reimbursement of expenses up to $500 per ticket for delays over 6 hours.

Complimentary Lounge Access

A standout feature of the Chase Sapphire Reserve card is the complimentary Priority Pass Select membership, providing access to over 1,300 airport lounges worldwide. This benefit offers a comfortable and luxurious experience, with access to amenities such as:

- Complimentary snacks and beverages.

- High-speed Wi-Fi for staying connected.

- Comfortable seating and workspaces.

- Shower facilities in select locations.

Fees and Charges

Understanding the fees associated with the Chase Sapphire Reserve card is crucial for effective financial planning. Here are the primary fees to consider:

- Annual Fee: $550, offset by the $300 travel credit and other benefits.

- No foreign transaction fees, making it cost-effective for international travel.

- Late Payment Fee: Up to $40, depending on the outstanding balance.

Is the Annual Fee Worth It?

The decision to pay the Chase Sapphire Reserve card's annual fee depends on individual spending habits and travel preferences. For frequent travelers who can fully utilize the card's benefits, the $550 annual fee can be justified by:

- Receiving a $300 annual travel credit, effectively reducing the fee to $250.

- Gaining access to airport lounges, which can save money on food and beverages during travel.

- Benefiting from comprehensive travel insurance, potentially saving costs on separate policies.

Tips for Using the Chase Sapphire Reserve

To make the most of the Chase Sapphire Reserve card, consider the following tips:

- Leverage the travel credit by using the card for travel purchases early in the year.

- Regularly check for special promotions or offers from Chase to earn additional points.

- Utilize the card's travel benefits, such as rental car insurance and trip delay coverage, to avoid additional expenses.

How Does It Compare to Other Cards?

The Chase Sapphire Reserve card competes with other premium travel cards, such as the American Express Platinum Card and the Citi Prestige Card. Here's how it stands out:

- Offers a more flexible rewards program with the ability to transfer points to a wide range of partners.

- Includes a significant travel credit that offsets the annual fee more effectively than some competitors.

- Provides comprehensive travel insurance benefits, which can be more extensive than those offered by other cards.

Frequently Asked Questions

What is the annual fee for the Chase Sapphire Reserve card?

The annual fee for the Chase Sapphire Reserve card is $550.

How does the $300 travel credit work?

The $300 travel credit automatically reimburses cardholders for travel-related purchases, such as flights, hotels, and taxis, effectively reducing the annual fee.

Can I transfer my Chase Sapphire Reserve points to other loyalty programs?

Yes, Chase Sapphire Reserve points can be transferred to a variety of airline and hotel loyalty programs at a 1:1 ratio.

Is there a foreign transaction fee with the Chase Sapphire Reserve?

No, the Chase Sapphire Reserve card does not charge foreign transaction fees, making it ideal for international travel.

How does the Priority Pass Select membership work?

The Priority Pass Select membership provides access to over 1,300 airport lounges worldwide, offering amenities such as snacks, beverages, and Wi-Fi.

What travel insurance benefits does the Chase Sapphire Reserve offer?

The card offers extensive travel insurance benefits, including trip cancellation/interruption insurance, auto rental collision damage waiver, and lost luggage reimbursement.

Conclusion

In conclusion, the Chase Sapphire Reserve card is a top-tier travel credit card that offers substantial benefits for avid travelers. With its lucrative rewards program, comprehensive travel insurance coverage, and complimentary lounge access, cardholders can enjoy a premium travel experience. While the annual fee may seem steep, the card's benefits and credits can offset the cost for frequent travelers, making it a worthwhile investment for those who value luxury and convenience in their travel pursuits.